-

$11.14$0.02 (0.18%)

NAVAs of 2/12/26 -

$341.4 MTotal Net AssetsAs of 2/12/26

-

0.91%YTD ReturnAs of 2/12/26

Fund Highlights

Managed by Trusted Advisors

Experienced team with long history of working with institutional investors.

Focused on the Alpha in Private Equity

Targeting small & middle market companies through co-investments and smaller & specialized secondaries.

Innovative & Efficient Investment Structure

Interval fund with cost effective access, daily purchases, and semiannual liquidity.

Performance

As of 1/31/26

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol CAPVX.

Contact UsMonthly Returns (%)

As of 1/31/26

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 6.37* | 0.90 | 1.70 | 2.75 | 12.20 | |||||||||

| 2025 | 0.33 | -0.67 | 5.55 | 6.41 | -0.17 | 3.19 | 0.10 | 2.90 | 3.20 | 2.45 | 0.92 | 0.57 | 27.44 | |

| 2026 | 0.45 | 0.45** |

*Partial month

**Performance value represents year to date

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value of an investment will fluctuate so that your shares, when sold, may be worth more or less than their original cost. Returns greater than 12 months are annualized.

The Predecessor Fund commenced operations on September 20, 2024. The performance quoted below is that of the Predecessor Fund and was adjusted to reflect the Fund’s estimated expenses of Class I Shares (with the exception of estimated Acquired Fund Fees and Expenses, the effect of which is already incorporated into the performance of the Predecessor Fund, and interest payments on borrowed funds and securities sold short, as the Predecessor Fund did not have the benefit of leverage) and the Fund’s Expense Limitation Agreement in effect for its first year as a registered investment company as well as the Management Fee Waiver. The performance returns of the Predecessor Fund are unaudited and are calculated by the Advisor on a total return basis. If the effect of the Fund’s Expense Limitation Agreement and Management Fee Waiver were not reflected in the Predecessor Fund’s returns shown below, the returns would be lower. After-tax performance returns are not included for the Predecessor Fund. The Predecessor Fund was a privately placed fund, was not registered under the 1940 Act, and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the Investment Company Act and the Code, which, if applicable, may have adversely affected its performance. The Fund Conversion itself was treated as a non-taxable contribution by the Predecessor Fund of limited partner interest to the Fund in exchange for shares of the interval fund, followed by a non-taxable liquidation of the Fund. However, to the extent the Fund had corporate investors, including a Cayman Islands exempted company organized to enable investment by non-US investors, the Fund will be subject to Fund-level corporate income tax on built-in gains with respect to a proportionate share of assets transferred in the Fund Conversion that the Fund (or a Private Equity Fund in which the Fund invests) disposes of within five years of the Fund Conversion.

Portfolio

Private Equity Portfolio Statistics

| Private Equity Investments: | 53 |

|---|---|

| Managers: | 35 |

| % of co-investments FMV in small and mid market companies1: | 85% |

| % of secondaries FMV in small and specialized transactions1: | 100% |

As of 1/31/26

Private Equity Portfolio Investment Sector Weightings

| Information Technology | 26.1% |

|---|---|

| Industrials | 22.1% |

| Health Care | 16.1% |

| Financials | 10.9% |

| Consumer Discretionary | 10.3% |

| Communication Services | 7.7% |

| Consumer Staples | 3.2% |

| Real Estate | 1.4% |

| Materials | 1.0% |

| Energy | 0.8% |

| Utilities | 0.4% |

As of 1/31/26

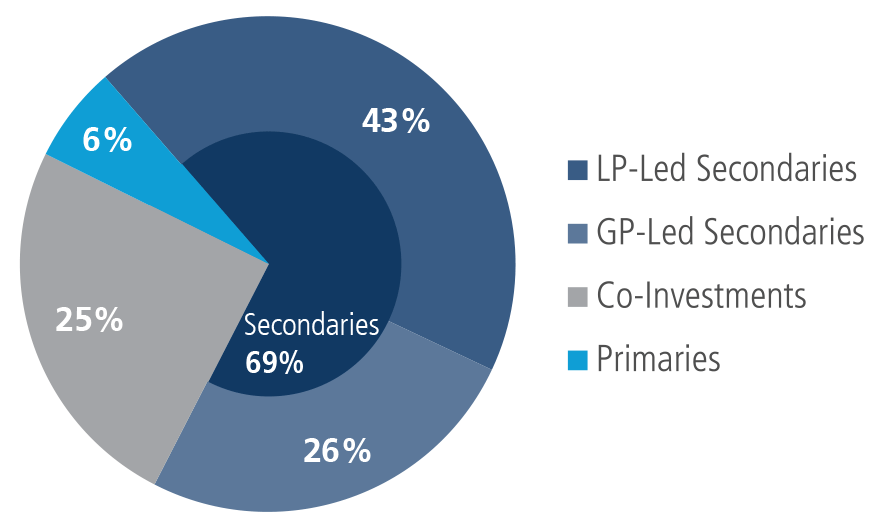

Private Equity Investment Type2

As of 1/31/26

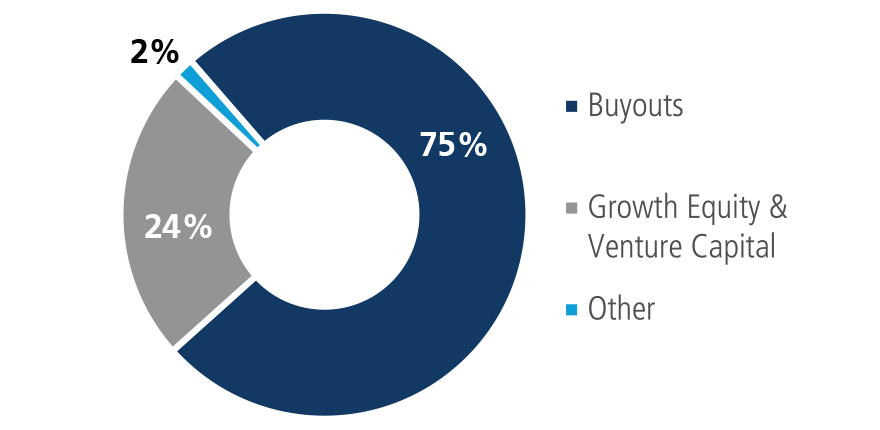

Private Equity Investment Strategy2

As of 1/31/26

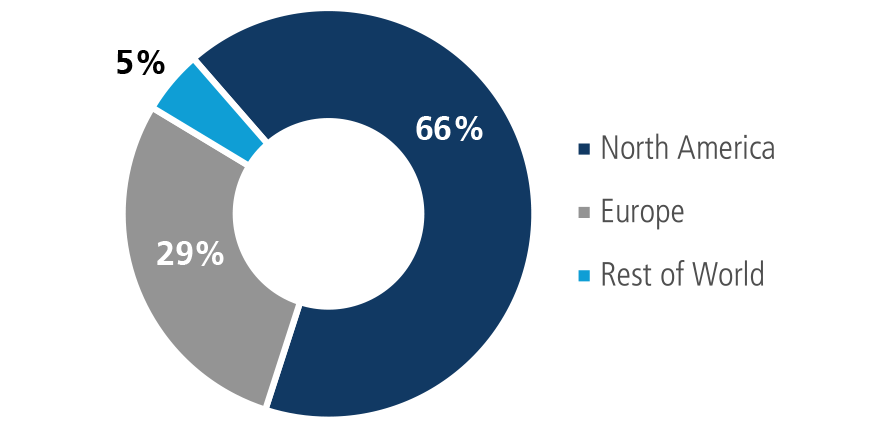

Private Equity Region2

As of 1/31/26

Top 5 Private Equity Holdings

As of 1/31/26

| Investment Name | Description | Investment Type | Strategy |

|---|---|---|---|

| Project Alpine | Secondary transaction of a diversified secondary fund primarily invested in North American and European buyouts. | Secondary | Buyouts |

| Project Draft | Secondary transaction of a diversified growth equity fund managed by a leading global sponsor. | Secondary | Growth Equity |

| Project SoftCircle | Secondary transaction of a growth equity fund primarily invested in high-growth, asset-light FinTech and InfraTech businesses. | Secondary | Growth Equity |

| Project Fuchsia | Secondary transaction of a diversified growth equity fund managed by a leading global sponsor. | Secondary | Growth Equity |

| Project Riva | Continuation vehicle for a leading technology provider of AI-driven, SaaS-based identity verification solutions. | Secondary | Buyouts |

Leadership

Eli Pars, CFA

Co-CIO, Co-Head of Alternative Strategies, Co-Head of Convertible Strategies, & Senior Co-Portfolio Manager, Calamos Investments

Michael Kassab, CFA

Senior Vice President, Chief Market Strategist, Associate Portfolio Manager, Calamos Investments

Matt Freund, CFA

Co-CIO, Head of Fixed Income Strategies, and Senior Co-Portfolio Manager, Calamos Investments

David O’Donohue

Senior Vice President of Alternative Strategies, Senior Co-Portfolio Manager, Calamos Investments

Distributions

Capital Gains

2025 capital gains distribution for Calamos Aksia interval funds were declared December 15, 2025. To view the report, click here.

Distributions

| Year | Distribution Per Share |

|---|---|

| 2025 | 0.01278 |

Fund Information

| Ticker: | CAPVX (Share Class I) |

|---|---|

| Objective: | Long-term capital appreciation |

| Structure: | Interval Fund (40-Act registered) |

| Accreditation Requirement: | None |

| Purchase: | Daily |

| Liquidity Terms: | Semi-annual repurchase of at least 5% of NAV |

| Distributions: | Annual |

|---|---|

| Tax Reporting: | 1099-DIV |

| Management Fee1: | 1.25% |

| Performance Fee: | None |

| Other Expenses1: | Capped at 0.35% |

Literature

About the Fund

Research & Education

Prospectus and Reports

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol CAPVX.

Contact Us