-

$10.30$0.01 (0.10%)

NAVAs of 2/13/26 -

$24.6 MTotal Net AssetsAs of 2/13/26

-

1.38%YTD ReturnAs of 2/13/26

Fund Highlights

Unique Access

Exposure to high conviction and diversifying managers

Aksia Investment Edge

Depth and experience in an attractive and complex asset class

Efficient Structure

Interval funds offer a versatile solution for investors

Performance

As of 1/31/26

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol HEDCX.

Contact UsMonthly Returns (%)

As of 1/31/26

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | 2024 | 0.33* | 0.36 | 0.50 | 0.88 | 0.72 | 1.37 | 1.10 | 5.38 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 1.55 | 0.64 | 0.09 | 0.19 | 0.66 | 0.81 | -0.03 | 0.51 | 0.68 | 1.30 | 0.59 | 1.05 | 8.35 |

| 2026 | 1.77 | 1.77** |

**Performance value represents year to date

Annualized Returns

As of 1/31/26

| Year-To-Date | 1-Year Return | Since Inception Annualized Return | |

|---|---|---|---|

| HEDCX | 1.77% | 8.58% | 9.40% |

Portfolio

Hedge Portfolio Statistics

| # of Holdings: | 32 |

|---|---|

| # of Substrategies: | 15 |

| Top 5 Holdings (% of Portfolios): | 27% |

| Top 10 Holdings (% of Portfolio): | 47% |

| Largest Holding: | 6% |

| Average Position Size: | 3% |

As of 1/31/26

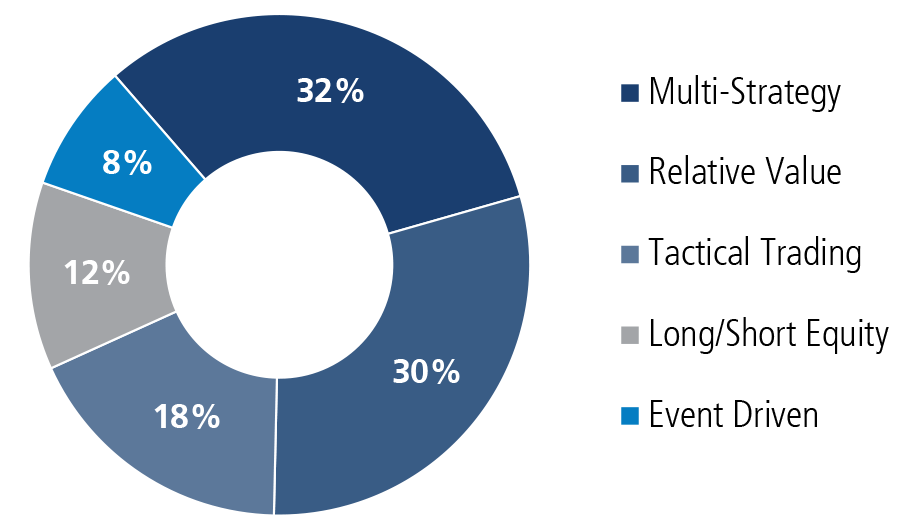

Portfolio Strategy1

As of 1/31/26

Hedge Fund Substrategy

| Relative Value Multi-Strategy | 22.8% |

|---|---|

| Global Macro | 11.4% |

| Fixed Income Arbitrage | 10.8% |

| Long/Short Credit | 10.4% |

| Directional Multi-Strategy | 9.2% |

| Multi-PM | 5.8% |

| Quantitative Strategies | 5.6% |

| CTA | 4.6% |

| Event Credit | 3.9% |

| Opportunistic | 3.5% |

| Event & Merger | 3.0% |

| Structured Credit | 3.0% |

| Fundamental Growth | 2.7% |

| Risk Mitigators | 1.9% |

| Activist | 1.3% |

As of 1/31/26

Top Hedge Fund Holdings

As of 1/31/26

| Holding | Strategy | % |

|---|---|---|

| Garda Capital Partners LP | Relative Value | 5.9% |

| ExodusPoint Capital Management LP | Multi-Strategy | 5.8% |

| Elliott Management Corporation | Multi-Strategy | 5.2% |

| LMR Partners LLP | Multi-Strategy | 5.1% |

| Balyasny Asset Management LP | Multi-Strategy | 4.7% |

| Two Sigma Investments LP | Relative Value | 4.6% |

| Verition Fund Management LLC | Multi-Strategy | 4.1% |

| Linden Advisors LP | Relative Value | 4.0% |

| Sculptor Capital LP | Multi-Strategy | 4.0% |

| Holocene Advisors LP | Long/Short Equity | 4.0% |

Leadership

David O’Donohue

Senior Vice President of Alternative Strategies, Senior Co-Portfolio Manager, Calamos Investments

Distributions

Capital Gains

2025 capital gains distribution for Calamos Aksia interval funds were declared December 15, 2025. To view the report, click here.

Distributions

| Year | Distribution Per Share |

|---|---|

| 2025 | 0.13662 |

Fund Information

| Ticker: | HEDCX (Share Class C) |

|---|---|

| Structure: | Interval Fund (40-Act registered) with daily purchase and quarterly repurchase |

| Accreditation Requirement: | None |

| Purchase: | Daily |

| Benchmark: | HFRI Fund of Funds Conservative Index |

| Secondary Benchmark: | Bloomberg US Agg Bond |

| Leverage: | Minimal leverage; permitted up to 33% |

|---|---|

| Liquidity Terms: | Quarterly; no less than 5% of outstanding shares |

| Distributions: | Yearly |

| Tax Reporting: | 1099-DIV |

| Management Fee1: | 1.10% |

| Performance Fee: | None |

| Other Expenses1: | Capped at 0.35% |

Literature

About the Fund

Research & Education

Prospectus and Reports

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol HEDCX.

Contact Us