-

$10.70$0.01 (0.09%)

NAVAs of 2/13/26 -

$1.10 BTotal Net AssetsAs of 2/13/26

-

1.11%YTD ReturnAs of 2/13/26

- 10.0%Private Credit Portfolio YieldAs of 12/31/25

Fund Highlights

Enhanced Income

Target attractive yield and lower correlation with a focus on principal preservation.

Diversified Exposure

Invests across the private credit asset class, beyond direct lending and corporate credit.

Institutional Access

Sources opportunities from hundreds of leading private credit originators and private equity sponsors.

Investor-friendly Structure

- Attractive fees – 1.25%

- Monthly distributions and quarterly repurchases

- 1099-DIV reporting

Performance

As of 12/31/25

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol CAPHX.

Contact UsMonthly Returns (%)

As of 12/31/25

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 0.30* | 0.80 | 0.89 | 0.59 | 0.71 | 1.67 | 1.08 | 6.19 | |||||

| 2024 | 1.07 | 0.77 | 1.44 | 0.96 | 0.95 | 0.66 | 1.08 | 1.00 | 0.69 | 0.97 | 0.97 | 1.35 | 12.59 |

| 2025 | 0.66 | 0.57 | 0.97 | 0.59 | 1.25 | 0.78 | 0.68 | 0.78 | 0.97 | 0.22 | 0.98 | 0.61 | 9.43 |

Annualized Returns

As of 12/31/25

| Year-To-Date | 1-Year Return | Since Inception Annualized Return | |

|---|---|---|---|

| CAPHX | 9.43% | 9.43% | 11.05% |

Portfolio

Private Credit Portfolio Statistics1

| # Underlying Loans: | 176 |

|---|---|

| # of Industries: | 44 |

| # Sourcing Partners: | 92 |

| First Lien: | 88% |

| Floating Rate: | 91% |

| Avg Loan to Value: | 47% |

| Avg EBITDA: | $166.0M |

| Duration (Years): | 0.24 |

| Avg. Maturity (Years): | 4.47 |

As of 12/31/25

Industry Weightings2

| Financial Services | 10.8% |

|---|---|

| Software | 10.2% |

| Real Estate Management & Development | 7.9% |

| Commercial Services & Supplies | 6.4% |

| Professional Services | 6.1% |

| Oil, Gas & Consumable Fuels | 4.5% |

| Insurance | 4.4% |

| IT Services | 3.9% |

| Media | 3.6% |

| Health Care Providers & Services | 2.7% |

| Construction & Engineering | 2.7% |

| Health Care Equipment & Supplies | 2.2% |

| Trading Companies & Distributors | 2.1% |

| Diversified Consumer Services | 2.0% |

| Health Care Technology | 1.9% |

| Consumer Staples Distribution & Retail | 1.8% |

| Machinery | 1.8% |

| Consumer Finance | 1.8% |

| Gas Utilities | 1.8% |

| Other3 | 21.5% |

As of 12/31/25

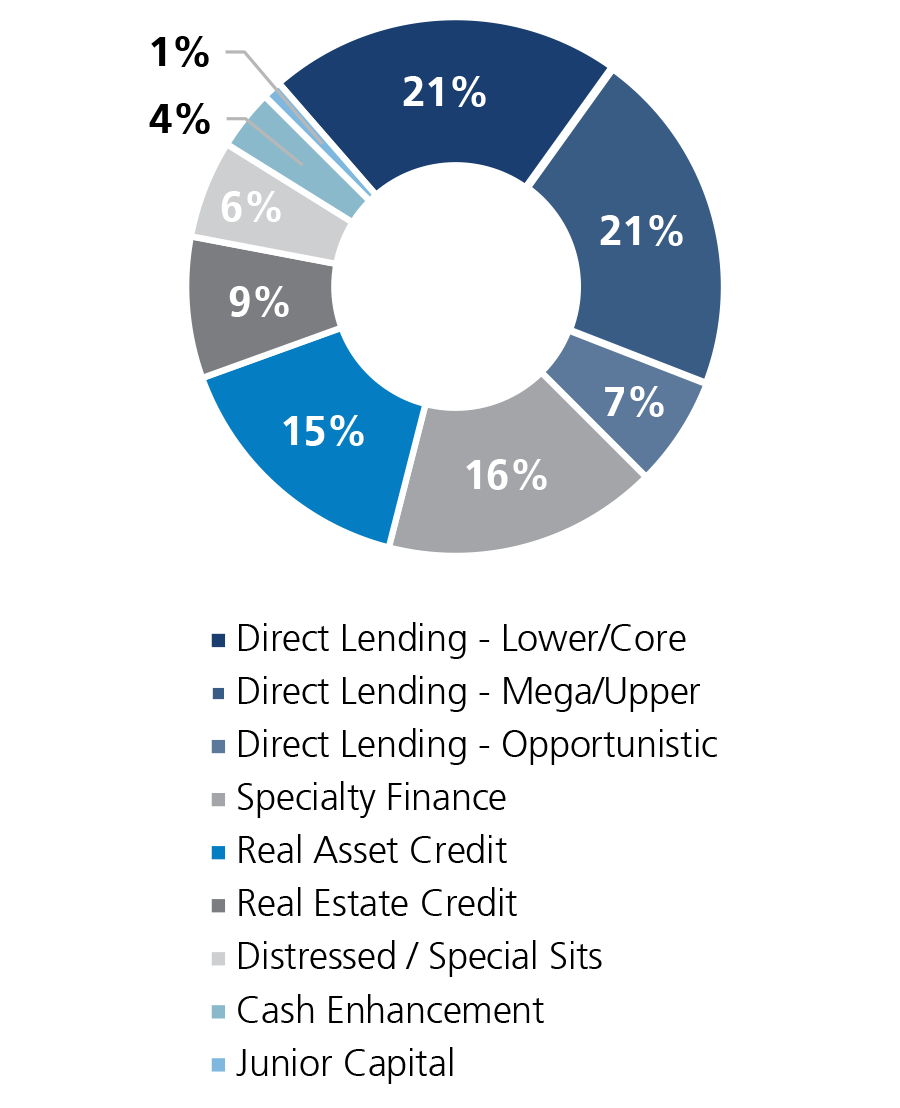

Private Credit Portfolio Strategy2

As of 12/31/25

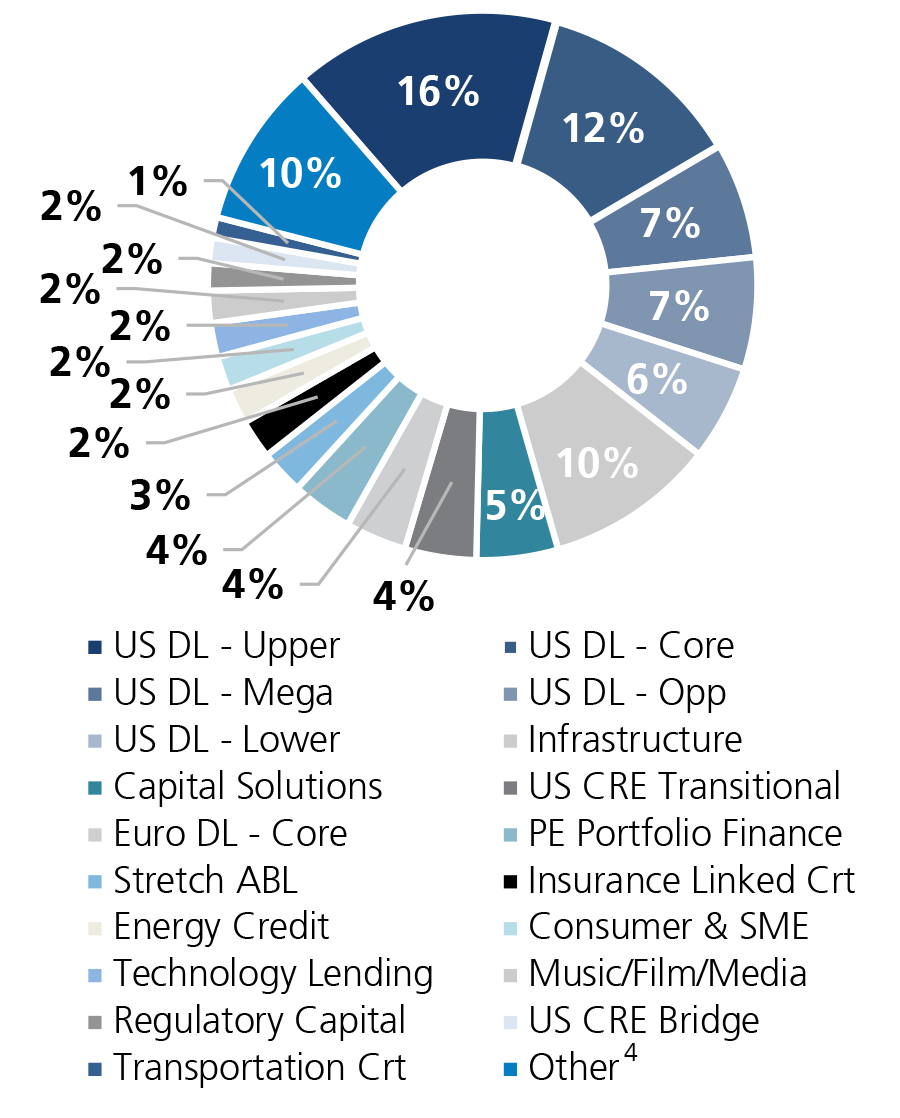

Private Credit Portfolio Substrategy2

As of 12/31/25

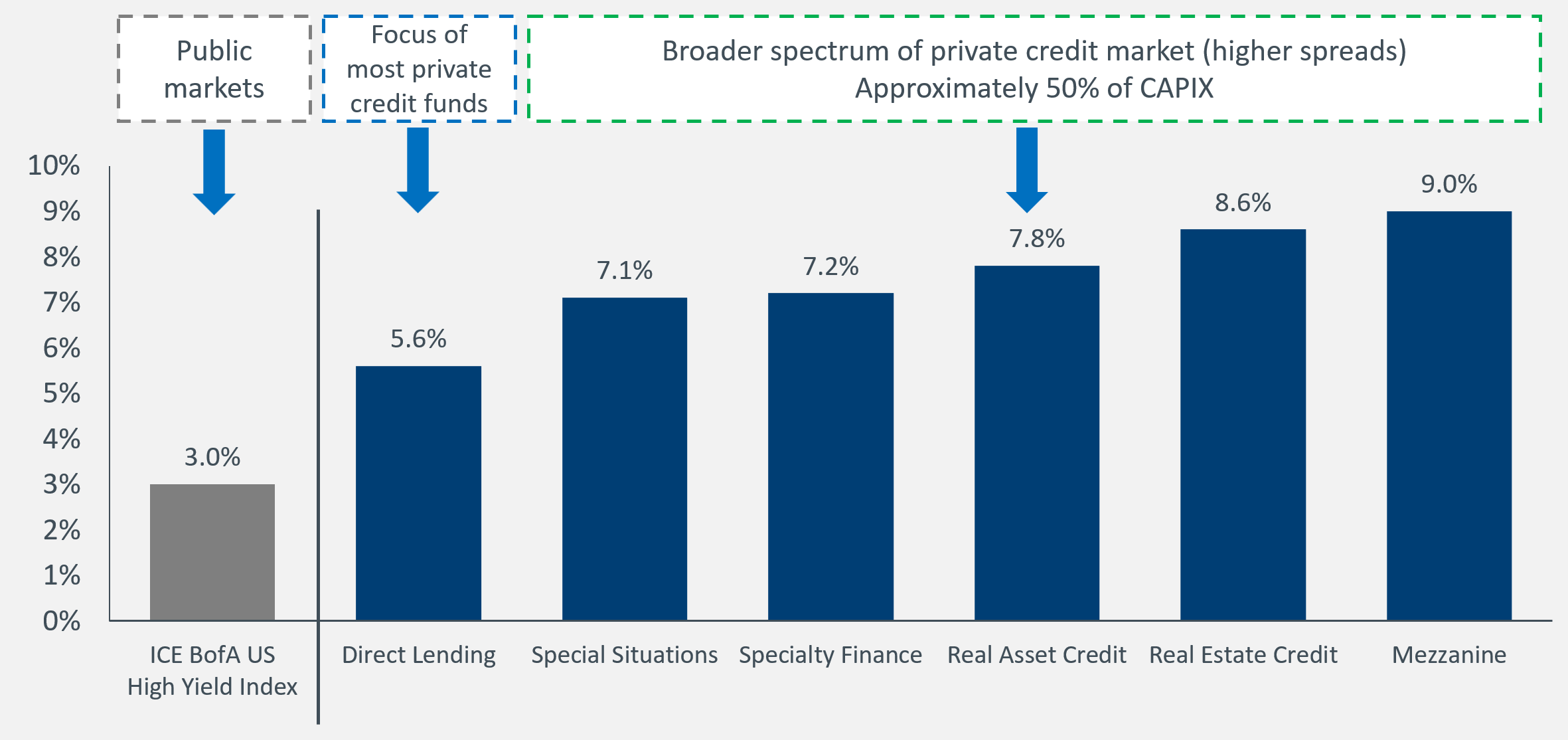

CAPIX Provides Diversification Across the Private Credit’s Sectors and Strategies

Direct Lending

- US direct lending

- European direct lending

- Emerging markets direct lending

Distressed Debt and Special Situations

- “Credit opportunities”

- Corporate distressed

- Opportunistic structured credit

- Real estate distressed

- NPLs

- Capital solutions/rescue finance

- “Special situations” loans

Speciality Finance

- Consumer and SME lending

- Rediscount lending

- Factoring and receivables

- Regulatory capital relief

- Royalties*

- Venture lending

- Technology lending

- Financial services credit

- Insurance-linked credit

- Litigation finance

- Stretch ABL

- NAV loans

- Structured secondaries

Real Estate Credit

- US corporate real estate (CRE lending: core transitional, bridge lending)

- European CRE lending

- Emerging markets CRE lending

- CRE structured credit

- Residential mortgages

Real Assets Credit

- Infrastructure lending

- Energy credit

- Trade finance

- Metals and mining finance

- Agricultural credit

- Transportation

Mezzanine

- US mezzanine

- European mezzanine

- Structured equity

- PIK Holdco

Median New Issue Spread By Sector

As of 6/30/25

Leadership

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer, Calamos Investments

Matt Freund, CFA

Co-CIO, Head of Fixed Income Strategies, and Senior Co-Portfolio Manager, Calamos Investments

Eli Pars, CFA

Co-CIO, Co-Head of Alternative Strategies, Co-Head of Convertible Strategies, & Senior Co-Portfolio Manager, Calamos Investments

Michael Kassab, CFA

Senior Vice President, Chief Market Strategist, Associate Portfolio Manager, Calamos Investments

Distributions

Capital Gains

2025 capital gains distribution for Calamos Aksia interval funds were declared December 15, 2025. To view the report, click here.

Fund Information

| Ticker: | CAPHX (Share Class A) |

|---|---|

| Objective: | The fund seeks attractive risk-adjusted returns and high current income |

| Structure: | Interval Fund (40-Act registered) with daily purchase and quarterly repurchase |

| Accreditation Requirement: | None |

| Purchase: | Daily |

| Benchmark: | Morningstar LSTA US Leveraged Loan Index |

| Leverage: | Up to 25% |

|---|---|

| Liquidity Terms: | Quarterly; no less than 5% of outstanding shares |

| Distributions: | Monthly |

| Tax Reporting: | 1099-DIV |

| Management Fee6: | 1.25% |

| Performance Fee: | None |

The Advisor, the Sub-Advisor and the Fund have entered into the Expense Limitation Agreement under which the Advisor and Sub-Advisor have agreed contractually until at least April 27, 2027 to reimburse certain other expenses incurred in the business of the Fund on a 50/50 basis, calculated and reimbursed on a Class-by-Class basis in respect of each of Class A, Class C, and Class I, with the exception of (i) the Investment Management Fee, (ii) the Shareholder Servicing Fee, (iii) the Distribution Fee, (iv) certain costs associated with the acquisition, ongoing investment and disposition of the Fund’s investments and unconsummated investments, including legal costs, professional fees, travel costs and brokerage costs, (v) acquired fund fees and expenses, (vi) dividend and interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Fund), (vii) taxes and costs to reclaim foreign taxes, and (viii) extraordinary expenses (as determined in the discretion of the Advisor and Sub-Advisor), to the extent that such expenses exceed 0.25% of the average daily net assets of such class. See the prospectus for estimated interest expenses and additional information regarding fees and estimated operating expenses.

Literature

About the Fund

Research & Education

Prospectus and Reports

How to Invest

Financial advisors and institutional investors can purchase fund shares on a daily basis, using the ticker symbol CAPHX.

Contact Us